RSA

Lectures

The

Ethics and Economics of the arms trade

*

Sir Samuel Brittan

28

March 2001

Every sensible market economist should

accept that a market must operate within a framework of law and moral

convention. Investment Bankers are

not permitted to finance firms that sell poison and there are strong constraints

on the emission of lead into rivers or on pollutants into the chain of

foodstuffs. My contention is that

exports of arms to dubious regimes should come within the sphere of what is out

of bounds – and more decisively so than at present.

Would we have

to pay a heavy economic price for such restraint?

There is indeed sometimes a conflict between national self-interest and

ethical actions, just as there can be a conflict between personal self-interest

and moral behaviour. But in both

cases this is often exaggerated. In

the national case it is exaggerated by an inflated view of the role of arms and

export promotion in the British economy.

The promotion and de facto subsidisation of arms sales is – like most other industrial subsidies – wealth destroying; there would be very little, if any, sacrifice involved in doing away with the whole effort. Behind the arms promotion lobby is the primitive belief that if one source of overseas sales dries up, the workers and other resources involved would waste away. This is rubbish in view of the millions of people who change jobs every year. If other countries want to compete with us in foolish subsidies, let them.

The ethical case

It might be

best to examine the ethical case before the economic arguments.

It is not my

intention to argue against all arms sales.

It would be absurd for each member of an alliance to try to make a full

range of weapons, simply out of amour propre, when specialisation would

pay far better. In 1998-99 the

Ministry of Defence spent 13% of its equipment budget on 64 co-operative

equipment programmes involving 19 partner nations.

The most important of these, by far, were France, Germany, the USA, Italy

and the Netherlands[i]

What I have

in mind is a more effective ban on the sale of arms to dubious regimes and an

end to subsidies for arms sales to any part of the world. In fact, I am against export subsidies of any kind; but those

for arms and heavy capital projects – which are often related – are a good

place to start. Those who accept my

thesis do not have to agree on which regimes are the most dubious.

There is a pretty clear basic list of regimes that commit aggression,

support terrorism or oppress large bodies of their own citizens; we can argue

about how far the list should extend.

Subsidised

credit for exports of arms or major capital goods have far worse effects than

just the economic ones. Western

nations are undoubtedly rich enough to waste some resources. As Adam Smith said: ‘There is an awful lot of ruin in a

nation.’

The worst

effects are political and moral. They

are both illustrated by the instance of the Pergau Dam in Malaysia in the mid

1990s when the Conservative government overturned a publicly minuted reservation

by the Permanent Secretary of the Department of Overseas Development and

insisted on supporting credits for this dam.

One of the

unstated arguments for going ahead was that this would act as a sweetener to

persuade the Malaysian government to buy other goods, including arms, from

Britain. On the other hand arms

sales are justified because they are supposed to persuade governments that buy

them to use British equipment in their capital projects. Thus one bad consequence is called in aid to support another;

and Third World despots are encouraged to devote still more resources to

military spending on prestige projects of dubious value.

More

recently, the Labour Prime Minister was said to have overruled the Foreign

Secretary when he authorised a statement by Stephen Byers on 21 December 1999

that he was ‘minded’, subject to certain conditions, to grant export credit

for the Ilisu dam project in Turkey, which will flood several valleys with sites

of unique cultural and religious value to the Kurds.

You can imagine what this will do to promote ethnic harmony inside

Turkey. In the spring of 2001 we

were still waiting for a decision.

We cannot

leave out of account the enormous part that bribery plays in this trade.

A forthcoming study by Joe Roeber concludes that: ‘Because of the

structure, complexity and capacity of the market, and above all, because of the

secrecy that surrounds every aspect of its activities, the international arms

trade is the most corrupt of all legal trades.’

He finally asks: ‘Can we justify bribing people to buy arms they may

not need with money their taxpayers cannot afford, simply to inflate the number

of jobs in a declining industry?’

All these

follies are supported by the myth that exports are valuable for their own sake,

however small the return the British nation gets from them.

Business lobbyists are able to persuade a succession of prime ministers,

ranging from ultra-dry Conservatives to New Labour that, if the government does

not support them, their overseas rivals will win the contracts instead.

I wish we had a prime minister with the analytical resilience simply to

reply ‘Let them.’

We should follow the example of General de Gaulle. When he was told that if the French left Algeria the Russians would take their place, he replied, ‘I wish them much joy of it.’ The same applies to UK or other governments that want to throw away their national resources on projects which not only do not pay domestically, but which are detrimental to genuine Third World development.

Orders of magnitude

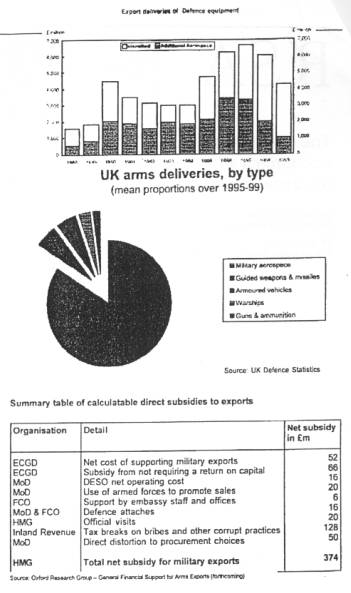

The official

estimate for British arms sales is that they amounted in 1999 to about £4bn or

appreciably less 0.5% of GDP (see charts).

A great part consisted of aircraft and aerospace parts.

A good academic estimate of the direct cost of government support is

about £400m per annum. This does not cover the arms promotion aspects of many royal,

political and military visits and activities, which are ostensibly for other

purposes. Indirect support for what

is known as the Defence Industrial Base is a good deal larger.[ii]

The number of workers employed is put at 90,000 or just over 0.33% of UK

employment.

There are two practical inhibitions that limit official export promotion. The first and obvious one is the Exchequer cost. Secondly there is the fear that official promotional activities will be self-defeating, and still more expensive, if all governments follow them in a competitive race. Accordingly, international organisations such as the European Union, the World Trade Organisation, the OECD and the Berne Credit Union have set rules to limit – but not stop – government support.

Unfortunately

these agreements do not prevent the never-ending procession of royalty,

ministers and ambassadors who promote arms sales abroad, to say nothing of the

military and trade attachés. Then

there is the Defence Export Services Organisation, which provides marketing and

military assistance. Above all,

arms sales are often backed by the Export Credits Guarantee Department (ECGD),

which provides ‘insurance and finance packages for exporters of capital goods

and services and political risk insurance’ – in other words, taxpayer

support for sales that would not pass muster on purely commercial terms.

While public

enterprises are set a target real rate of return of six per cent, the ECGD has

to do no more than break even on average. The

ECGD covers medium to long-term capital goods exports from three years up to 16

years duration. In a typical year

it underwrites about £7bn of cover. The business is concentrated almost entirely on civil

engineering projects and military and civil aerospace.

The largest recipient is China. The

military share of ECGD business has averaged over 25% in the most recent five

years.

The much-maligned Treasury tends to fight many ECGD deals, but is often defeated. Huw Evans, a former Treasury deputy secretary, has said that the ECGD is too vulnerable to intensive lobbying of ministers by large corporations and that it should become an independent agency. As Andrew Tyrie MP, a former adviser to Conservative chancellors has written, ‘It is illogical to indulge in a competition to give away our own exports through an auction of subsidies.’[iii]

Small Arms

The problem,

however, is not confined to officially supported exports of high technology

equipment such as aircraft and missiles. It

is most often small arms that have been used for domestic repression in armed

conflict in the last decade – the vast majority of them civilians and most of

them killed by small arms.

Clare

Short’s 2000 White Paper on International Development stated: ‘Of the 40

poorest countries in the world, 24 are either in the midst of armed conflict or

have only recently emerged from it. This

problem is particularly acute in Africa…

An estimated five million people have died.’[iv]

Sophisticated defenders of arms sales agree that there is a case for

banning exports of small arms altogether except for the armed forces of western

democratic states. For instance

Philip Towle argues that the profits Britain makes from this trade are very

small despite the benefits to some specialised manufacturers.[v]

The Scott Report of 1996 advocated legislation to put control on arms exports and arms brokering on a permanent non-emergency basis. In the spring of 2001 the Labour government undertook to introduce such legislation in the next parliament and published a draft bill with explanatory memoranda. This will introduce a licensing requirement for trafficking and brokering in arms between overseas countries. It will also introduce licensing requirements for export of military technology by electronic means. Nevertheless the government is still likely to be inhibited by two factors: its reluctance to move too far ahead of competitor countries and its belief that small arms can legitimately be sent to official governments as distinct from so called rebels.

Al Yammamah

There is a

further category which is not overtly a subsidy, but is certainly a special

arrangement. This is the obscure Al

Yammamah deal with Saudi Arabia under which weapons were exchanged for oil.

Full details

have never been published, but a great deal of information has been collected in

The Arabian Connection, published by the Campaign against the Arms Trade,

which is a useful source even for those who might not agree with all the

objectives of the Campaign.

The first

Yammamah deal was negotiated in the middle to late 1980s and has its origin in

the reluctance of the US Congress to sanction weapons exports to Saudi Arabia.

American policies have fluctuated since then; but a second Yammamah

agreement was negotiated in the late 1980s; and despite may difficulties it

became operational in the early 1990s. Its

biggest ‘achievement’ was to produce a market for the Tornado aircraft,

which was said at one time to have saved 19,000 jobs.

The Blair government shows no sign of wanting to banish this kind of agreement, despite the distortions that the heavy investment in arms is producing in Saudi Arabia, the horrific human rights record of the regime there, and the basic instability of that regime. As for the argument about oil supplies, I have never seen why the US, Britain and France cannot – like other western countries – buy their oil on the international market, remembering that Middle Eastern countries often need to sell the oil even more urgently than we need to buy it. It is interesting that this so-called argument of economic strategy usually comes from foreign ministries rather than ministries of finance or economics.

The UK record

The recent UK

record is not all bad. In July 1997

the then new British Foreign Secretary Robin Cook stated that the new Labour

government would not permit the sale of arms to regimes that might use them for

internal repression. It is the

least he could have said after the Arms for Iraq scandal.

The

government has fulfilled an election pledge to publish annual reports on UK’s

strategic export controls. These

have gradually improved in quality; and the third one, issued in July 2000, has

been described by Saferworld as ‘the most transparent report published by any

European country and one which offers a potential template for best practice

through the EU.’[vi]

But even this latest report is criticised for failure to provide

information on ultimate end users, the absence of summary information on

licences refused and lack of detailed information on actual deliveries, as

distinct from licences.

The Blair

government inherited various international obligations such as membership of the

Australia Group of 30 countries aiming to discourage the proliferation of

chemical and biological weapons. An

international convention was reached in December 1997 banning the production and

transfer of anti-personnel mines. This

came too early to be attributed to the Labour government elected in the same

year.

But the new

government indeed took a lead in pressing for a European Union Code of Conduct

on Arms Exports which was agreed in June 1998.

The Chancellor of the Exchequer, Gordon Brown, began the millennium by

adding 22 new poor countries over and above the previous 41 covered by the ban

on export credits ‘for unproductive expenditure’.

Indonesia,

however, remains off the banned list. And

because the Chancellor’s action was in the context of debt relief for poor

countries, it did not affect Saudi Arabia, which has accounted for about one

third of British arms sales. It is

thus fair to say that there is still a long way to go.

Amnesty International’s view has been that the Department of Trade and

Industry ‘is not meeting its responsibility to promote trade in a manner which

is not harmful to human rights.’[vii]

It was also worried that this same department is responsible both for the

licensing of arms sales and for their promotion.

A joint report of four House of Commons committees reiterated that a

serious error of judgement was made in late 1998 and early 1999 in granting

several open export licences for military equipment to the government of

Zimbabwe, despite that government’s heavy involvement in the fighting in the

Congo and its domestic infringements of human rights.

The same report urged considering a stricter interpretation of the arms

embargo on China and also raised issues about licences for arms to other

countries.[viii]

At the height of the East Timor crisis in early 1999 there appeared a telling Times cartoon. On one side of the cartoon a buoyant Tony Blair was shown exclaiming: ‘We need a hawk’ – meaning a more determined military effort to put pressure on the government of Indonesia. On the other side he was shown piloting one of the Hawk aircraft that the UK had been delivering to Indonesia for many years for the use of the country’s former military dictator, General Suharto.

Export Promotion

A popular

view is that some arms sales may be undesirable, but that they help promote

jobs, growth and employment. Therefore

a balance has to be drawn between these two considerations – a compromise

always appeals to the so-called practical man.

We will thus never really stop dubious arms sales until the myth of the

export drive is nailed once and for all.

The root of

the matter is the belief throughout the political and business establishment

that exports are worthwhile for their own sake, irrespective of the terms on

which they are sold and how much they have to be subsidised.

It is for this reason that prime ministers, whether Thatcher, Major or

Blair, time and again come down against the Treasury in favour of controversial

arms deals or dubious overseas capital projects.

These attitudes are a hangover from the siege economy days of Stafford

Cripps (Labour Chancellor in the late 1940s) and have no place in a global

market economy.

The balance

of payments preoccupation goes back many centuries. Mercantilist writers in the 16th, 17th

and 18th century, campaigned for a favourable balance of trade and

for an inflow of gold and silver. These

writers were refuted as conclusively as anything can be in political economy by

18th century members of the Scottish Enlightenment such as David Hume

and Adam Smith. During the

subsequent period of rapid world economic growth towards the end of the 19th

century huge current account surpluses and deficits built up, far greater than

any of the imbalances which commentators have bemoaned in recent decades.

The origin of

both the export drive and the reinvention of so-called balance of payments

problem was in the immediate post-war years when sterling was on a fixed

exchange rate and was also inconvertible. The

financial policy regime was then one of suppressed inflation, which tended to

spill over into the balance of payments, and which was held down by a mixture of

controls and exchange rate overvaluation.

It was,

moreover, a world with strict controls over capital flows.

These controls could not be severe enough to protect determined

speculators from launching an attack on a suspect currency, but they were enough

of a deterrent to the regular flows of capital across borders which normally

finance imbalances on current account. The

post-World War Two generation of political and economic leaders was brought up

on slogans and posters such as ‘export or die’, the ‘dollar drive’ and

even on one occasion ‘exporting is fun’.

By contrast

we are now back in a world of relatively free capital flows.

There are bound to be large imbalances between countries with high

savings ratios and relatively few investment outlets and other countries, such

as the United States, which have had low savings but many investment

opportunities. Moreover we now have

floating exchange rates.

Advanced

industrial countries with floating exchange rates need never have balance of

payments problems. They may suffer

from unwelcome downward pressure on their exchange rate due to financial

market’s distrust of their policies or of fears about domestic inflation.

If so, such fears should be tackled directly.

In today’s circumstances export drives really amount to the diversion

of public resources towards special interest groups under the guise of patriotic

slogans.

The basic political and business fallacy is not to realise that exports, like investment, are a cost and not a benefit. If we could finance the imports that British citizens want to buy without any exports – say by interest-free loans from overseas on indefinite repayment terms – we would be better off. Of course this would require a period of adjustment. But such adjustments are necessary after any kind of economic or industrial change. In the world as it is, exports are a waste of resources and serve no purpose if they are not paid for, or are paid for very late and on a heavily subsidised credit basis and with a strong political risk factor.

The jobs argument

The most

popular argument for subsidising exports is the effect on jobs.

We should be on our guard when politicians defend dubious policies by

declaring ‘jobs are at stake’. This

is so whether it is an ‘Old Labour’ supporter wanting to protect

manufacturing, a Tory spokesman talking about the employment provided by

hunting, or a business lobbyist pushing for arms sales to dubious regimes.

The argument

that jobs derived from exporting weapons cannot be replaced is akin to the

argument for keeping open uneconomic coalmines for the sake of employment.

Yet it is often just those people who lecture us on the need for workers

to change jobs, and who say that full employment cannot the same employment, who

are most keen to promote the sale of arms.

Such

arguments are based on the myth that there is a lump of labour that is engaged

in making specific products. Then,

it is supposed, if orders or output are lost in one area they cannot be regained

anywhere else. But people change

jobs constantly. Well over three

million people leave the unemployment register each year even in recession

periods, over half of them for new jobs or training.

Indeed, it is almost certainly easier for arms workers, many of whom have

a wide range of valued skills, to find new jobs than it was for miners, whose

training was more specific

There are

those who ask, ‘Where will the new jobs come from to replace those lost in

exporting weapons?’ The onus is

on them to explain how it is that other jobs, on a much greater scale, arose to

take the place of handloom weavers or the drivers of horse-drawn carts – or

for that matter the owners of pack-asses replaced by wheeled traffic at the dawn

of history. The multiplication of

population and the multiple rise of productivity in the last two centuries, so

far from these having caused mass unemployment, have been accompanied by a

multiple increase in the number of jobs.

One of the key ideas of economics is that of the circular flow of income. The point is that there is a continuing flow between purchasers who desire to buy products, the incomes received from supplying their needs, and still further purchases. The idea is so basic that economists regard it as too obvious to mention and take it for granted rather than discuss it explicitly.

The smoothness of this flow can be helped by sensible policies, such as efforts by the Bank of England Monetary Policy Committee to maintain an adequate, but not excessive, flow of total spending, and by sensible exchange rate policies. The interested citizen needs to know mainly that there is or can be such a circular flow, and that there therefore need be no fear of one country being undercut in everything by another.

Terms of trade

A slightly

more respectable argument is that relating to the terms of trade.

A royal visit or a small amount of official publicity, or arm-twisting by

the Foreign Office, might enable a company to sell more overseas at a given

price or to sell a given amount of goods at a higher price.

This enables the home country to exchange exports for imports on slightly

more profitable terms.

The argument

has very little application in a highly competitive world where a country of the

size of Britain has little monopoly power.

If e-commerce means anything at all this should vanish completely as

buyers are able to find the most competitive offer unaided by royal visits.

A further argument relates to small exporters, who might not have the resources to engage in the required market research and export promotion. But surely this kind of thing is the job of market research and advertising agencies, chambers of commerce and industry associations. If it does not pay them to engage in such promotion, it is because government support agencies are providing these services on a free or subsidised basis.

Spillover benefits

The last resort of any sector or industry whose subsidies are challenged is to say that it brings spillover benefits to the rest of the economy. Concorde was virtually launched on such arguments.

Weapons producers argue that the government should continue to support exports because the proceeds contribute to the overhead costs of firms supplying the British military. These considerations cut both ways. The drive for arms sales itself distorts the design and production plans of British manufacturers and, in the view of some defence economists, offsets the savings in overheads. In any case, only some arms exports would be affected by a ban in the spirit of our supposedly ethical foreign policy. The posited economies of scale could readily be achieved by greater specialisation among Nato counties – a process inhibited by the desire of so many governments to protect domestic firms.

The NERA report

Many of the

issues I have discussed are highlighted by a report on export credit by the

National Economic Research Associates (NERA).[ix]

There has been some misguided celebration of the fact that NERA did not

recommend that ECGD should be privatised. But

the more important question is whether the provision of insurance cover should

be subsidised.

Until 1991,

the Department showed heavy cash flow losses.

It was then instructed to break even in cash flow terms in line with

Berne procedures. But the ECGD is

still, as I have already mentioned, not required to show the positive return of

6% in real terms normally required on public sector investment projects.

NERA could not find any justification for the subsidy – a most

important finding which the vested interests involved have contrived to bury.

NERA’s

first preference is for an internationally negotiated phasing out.

We must also face the question of whether there is a case for the UK

moving further ahead on its own. But

much more important than any of these details is the fact that reports such as

NERA’s are based on a mutually convenient misunderstanding.

Economic research organisations, trying to unearth a case for

intervention and subsidy, tend to focus on lapses from perfection inherent in

almost all markets: matters such as informational barriers facing potential new

exporters, and which governments might be able to help overcome by activities

such as trade fairs or start-up credits. NERA

indeed found such imperfections.

Politicians and opinion leaders take such reports, however, as confirmation that, without export promotion, the balance of payments would go haywire, the country become bankrupt and thousands of jobs would be lost. They conveniently overlook the fact that these bankruptcy and job fears are dismissed in polite terms as fallacies not worth serious consideration. NERA for instance remarked that the last thing the overheated British economy needed was extra demand for labour. Even in the year 2001 when there was a risk of recession, selective aid to a few heavy goods or arms manufacturers would have been an extremely inefficient way of stimulating demand.

Industrial case studies

Few critics would suggest a complete ban on arms sales; but a cut of one-third would effectively eliminate the most dubious items (see chart below). Let us suppose, then, that British arms exports were cut by £1 billion or £2 billion a year. Let us grant that these exports would have to be replaced or imports reduced in their stead. But there is no more a fixed lump of exports than there is a fixed lump of jobs.

UK Employment Figures

|

|

1998/99 |

|

Total UK employment Employment from DoD expenditure Employment from military exports Number of jobs lost with a 1/3 reduction in exports |

27,787,000 255,000 90,000 30,000 |

In fact, this arithmetic is far too

generous to the arms lobbies. It

would apply if we were talking about an industry that does not receive special

government help; in that case, the resources involved would have to move to

their next best use. But arms sales

do not represent, even in the narrowest economic terms, the best use of national

resources. They are so heavily

supported by the taxpayer that there might actually be a gain in moving the

workers, plant and technical skills to other activities that could pay for

themselves.

Let me cite two related bottom-up industrial studies. These have examined the impact of a one-third reduction in arms exports based on the average of the decade 1985-95 when the size of the arms sector was somewhat larger than it became at the of the century.[x] The output of weapons and ammunition would have been cut by about 12% and of aero products by nine per cent.

The maximum number of jobs lost would have been 40,000. On the basis of labour turnover estimates, the authors estimated that 40% would have found new work within a year and another 13% the year after that. About 27% would have taken more than two years to find a new job. Some 20% would have left the labour force. The impact would have been greatest where defence employment is concentrated in one or two plants in individual towns such as Bristol, Plymouth, Yeovil and Preston.

The hypothetical one-third cut in arms exports would have initially reduced total exports of all goods and services by some 0.5%. Nearly half of this half would have been replaced by alternative exports produced by redundant workers finding new work within a year. The remainder could be found partly from those finding work later and partly through other shifts within and between industries.

We are

talking about the loss of 0.25% of UK exports of goods and services.

This might, at worst, involve a miniscule devaluation and some slight

adjustment in monetary and fiscal policy. If

we cut through the technicalities, the cost could be a tiny deterioration in the

terms of exchange between British exports and imports from overseas.

The academic

authors search for some positive overspill benefits from promoting military

exports. The largest they can find

is the contribution of exports to the overhead cost of firms which serve the

home market as well. The second

largest comes from the contribution of exports to development costs.

Against these

modest industrial costs have to be set government budgetary savings.

A more subtle saving is that the government now has to take into account

not only value for money but supposed industrial and employment benefits in

placing military orders. In 1995 a recommendation by the Equipment Approvals Committee

in favour of the American designed Chinook helicopter was overridden by the

Secretary of State for Defence in favour of a mixed order involving Westland.

Netting all their estimates out, the defence economists arrive at an annual

budgetary gain of £76m from the postulated cut in arms sales.

One does not have to pretend that these estimates are precise or that the

cost saving is enormous. The thrust

of the argument is that the net effects on the British economy of reducing arms

sales are negligible or even favourable.

Similar

results have been emerging in France. A

Committee of the French National Assembly was given an analysis of 21 of 42

programmes of French arms exports which were said to have reduced purchasing

prices for the French armed forces. The

conclusion was that for half of these the gains of scale were countered by

various factors, such as changes in specifications and delays.

For the other half the scale effect did not lead to any reductions in the

prices paid by the French government because the profit from the extended

production lines went to the companies.[xi]

The Committee also quotes Denis Ranque, chairman of the Thomson-CSF group who told the Defence Committee of the Assembly on 28 March 2000 that ‘although many of the group’s non military activities sprang from earlier defence programmes, the reverse was becoming more and more frequent, as the new civilian technologies were now being incorporated in weapons systems. This development .. encouraged the group to seek a presence in the new civilian technology sector in order to maintain competitiveness in defence production.’

Why size matters

There is one aspect of the argument that I still need to explain more fully. That is the relationship of the a priori argument about the circular flow of income and the automatic adjustment of the balance of payments, to numerical estimates of the size of the sector and the modest nature of the adjustments involved in eliminating dubious exports.

Suppose we were talking about 50% of total exports or four or five million workers? Would this affect the argument? The answer is mainly in the time dimension. Any change in the pattern of demand leads to some adjustment problem. If the adjustment is large, care has to be taken by monetary and fiscal policy to maintain total demand; special efforts have to go into retraining; and there is a case for phasing out the change, if at all possible, to give those concerned time to adjust. But when we are talking about a modest fraction of a small and declining industry these adjustment problems are second order. Obviously a few constituencies are involved; but the change is much less than the normal adjustments which take place in a typical year through economic circumstances without any change of policy.

Others will take the trade

The favourite business argument, which one hears particularly, but not only, in relation to arms sales, is that if the British government does not promote them, the American, French or Chinese or other governments will, leaving Britain as usual as the mug. I am all for international disarmament treaties; and I have already mentioned such agreements.

But supposing

that other countries do not go all the way?

It is like saying that you should not stop knocking your head against a

brick wall until your friends have also stopped knocking theirs.

Or to drop the metaphor: national resources should be left to go to where

they enjoy the highest rate of return even if this causes a loud protest from

companies that have been used to being artificially supported.

The argument that others will export weapons if Britain desists is a dangerous defence for any aspect of the arms trade. ‘The very same argument was used to defend the slave trade in the 18th century and the opium trade to China in the 19th century.’[xii]

Way ahead

Finally, I

come to a question that I am often asked by friends in government circles.

What additional measures would you like to see taken?

Those who know more about the details of the arms trade than I do are

best placed to advise on the specifics. But

let me end with a few suggestions nevertheless.

Full support should be given to the 2001 UN Conference on Small Arms

Exports and any resulting recommendations.

But what else can an individual government do?

1.

DFID Intervention. One of

the greatest safeguards against the irresponsible grant of licences for arms

export is the ability of the British Department for International Development

(which it did not have under previous governments) to object to arms contracts

on the basis that they are harmful to the recipient country’s development.

Unfortunately it can still only do this on a case by case basis.

It is often difficult to argue that one limited delivery would have much

impact either way. If the Department were able to take a cumulative view of all

the licences requested by or granted to a particular country, this would be a

great step forward.

2.

Greater Transparency. Despite

the improved UK Report on Strategic Exports, the criteria for approving them are

still not clear. We need a list –

covering military aircraft and dual use products as well as other arms – of

countries to which complete bans apply, ones where there are no restrictions and

intermediate cases. In the latter

case we need a clear statement of the criteria, covering the quantities and kind

of arms which might be allowed.

3. End subsidies. There should be absolutely no official export credit for arms exports of any kind. Even permitted exports in uncontroversial cases should have to pay their way.

4.

Arms sales should only be permitted to actual or potential allies.**

5.

Governments should use their influence on international aid organisations

including the IMF, the World Bank, the EBRD and other regional banks on the

following lines:

-

To take a much stricter line on excessive investment in military hardware at the expense of genuine development. To do this, these agencies would have to return to their original functions and cease to be arms of US and Nato diplomacy.

-

To insist on enforcement of a clampdown on small arms exports – other than in restricted andpermitted categories – as a condition for receiving any aid at all.

6.

There should be an authoritative audit of the cost and benefit of all UK

arms sales. This should be carried

out outside government for instance by the National Audit Office which is

directly responsible to Parliament.**

A study instituted by the Ministry of Defence will not suffice.

7. Official export credit agencies should have to earn the normal rate of return on capital applicable to other public investments.

8.

(The abolition of the ECGD itself. This

might now appear far fetched and Utopian, but would be less so if the other

steps were taken).

I was tempted to conclude with a more resounding moral statement, which would not be too difficult. But the most important thing is to keep going in the right direction in the face of the counterattacks to be expected by every kind of interest group and prejudiced viewpoint.

Sir Samuel Brittan

Columnist,

the Financial Times

8 John Adam Street, London

* I am much indebted, especially for help on the numerical estimates, to Paul Ingram of the Oxford Research Group and to Robin Oakley of the Campaign Against the Arms Trade

**

I

am indebted to a speaker at the April conference of Transparency International

for these two suggestions.

References

[i]

Maximising the Benefits of Defence Equipment Co-operation.

Report by the Comptroller and Auditor General, 16 March 2001.

[ii]

Oxford Research Group and Safer World, Government Financial Supports for

Arms Exports, forthcoming.

[iii] Financial Times 3 February 1991

[iv] Eliminating World Poverty, DFID, December 2000

[v] P Towle, Ethics and the Arms Trade, Institute of Economic Affairs, 2000

[vi] Transparency and Accountability in European Arms Export Controls. Saferworld, December 2000

[vii]

Amnesty International, Human Rights Audit¸1999 and 2000

[viii] Strategic Export Controls: Annual Report for 1999, HC212, 6 March 2001

[ix] The Economic Rationale for the Public Provision of Export Credit Insurance. ECGD, 2000

[x] Stephen Martin, The Subsidy Saving from Reducing UK Arms Exports, Journal of Economic Studies, Volume 26, Number 1, 1999.

S Martin, K Hartley and B Stafford, Impact of Restricting UK Arms Exports, International Journal for Social Economics. Volume 26, number 6, 1999.

[xi] French National Assembly, Report filed under Article 145 of the Regulation by the Committee on National Defence and the Armed Forces, 2000

[xii] Towle, Op. cit.